KEY HIGHLIGHTS

- Singapore woman shocked by a S$903.61 dental bill for a routine visit at Jurong Point.

- Dentist allegedly assumed insurance was unlimited, resulting in disputed charges.

- Case has been reported to authorities, with clinic now conducting an internal review.

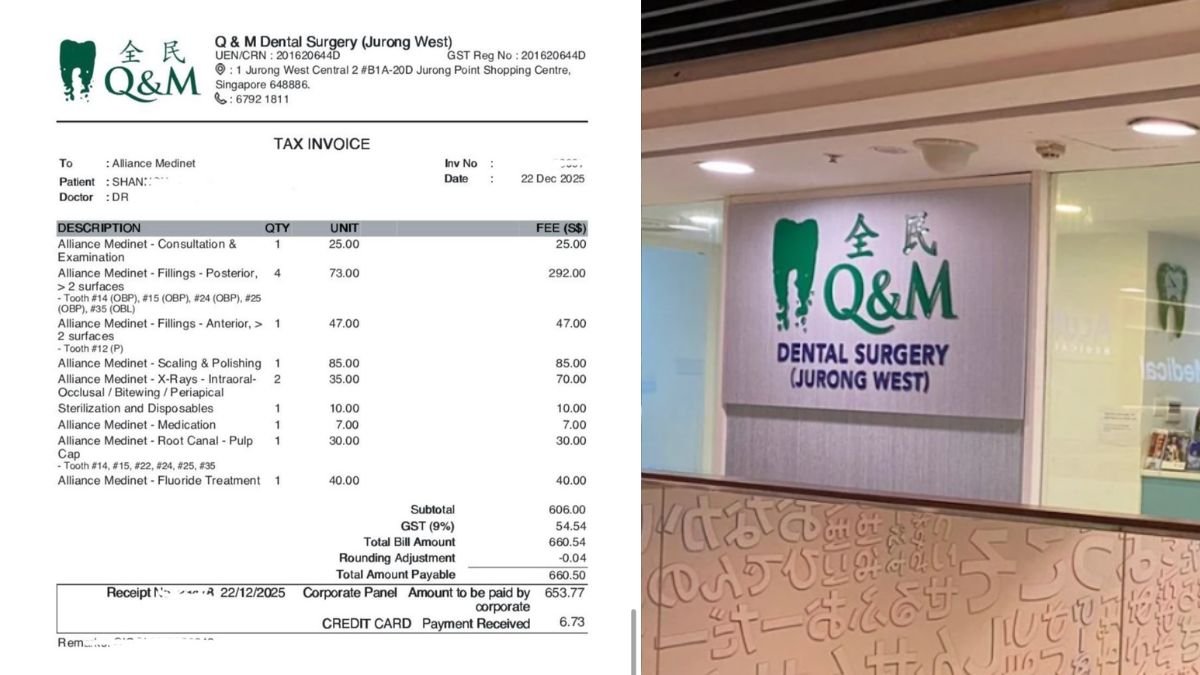

A simple dental appointment turned stressful for a Singaporean woman after she was quoted a bill of S$903.61 — for what she believed was just scaling and polishing. The visit took place on 22 December, at a Q&M Dental Surgery outlet in Jurong Point.

The woman, Shannon, shared that she was expecting the usual charges to be largely covered by her company’s dental insurance, which has a cap of around S$600. Instead, she was told she needed to pay more than S$200 in cash on the spot because the bill had exceeded her coverage.

Caught off guard, she decided to take a closer look at the invoice before making payment — and that was when things started to feel off.

| Item | Initial Bill (S$) | After Amendment (S$) | What She Says Was Actually Done |

|---|---|---|---|

| Consultation | Included | Included | Yes |

| Scaling & Polishing | Included | Included | Yes |

| Fluoride Treatment | Included | Included | Yes |

| Dental X-rays (2) | Included | Included | Yes |

| Fillings | Charged | Still Charged | No |

| Root Canal Cap | Charged | Removed | No |

| Total | 903.61 | 660.54 | 239.80 |

Charged for Procedures She Says Never Happened

According to Shannon, the 30-minute appointment only involved a consultation, scaling and polishing, fluoride treatment, and two X-rays. The dentist had even told her that the X-rays looked good, with no decay detected.

However, the original bill listed multiple fillings and a root canal cap — treatments she insists were neither discussed nor performed. When she refused to pay, she was brought back to speak with the dentist.

Shannon said the dentist apologised and admitted she had assumed Shannon’s insurance coverage was uncapped. After adjusting the charges, the revised bill dropped to S$660.54, more than S$300 less than the original amount.

Even then, Shannon felt uneasy. The amended bill still included procedures she said she did not agree to or receive. Based on standard clinic rates, she estimated the actual services should have cost only S$239.80.

“This Shouldn’t Happen” — Concerns Over Ethics

Honestly speaking, what worried Shannon most wasn’t just the money. She said she was “deeply concerned” about being billed for treatments that were not rendered, especially when company insurance benefits were involved.

From her perspective, a dentist should charge strictly based on what is done — no more, no less. Anything else crosses into uncomfortable territory, particularly when patients may not fully understand itemised dental bills.

Adding to her frustration, when she asked for a copy of the original S$903.61 invoice, she was told it had already been thrown away by counter staff.

A Pattern From a Previous Visit?

The situation became even more troubling after Shannon reviewed an earlier invoice from August, following a similar scaling and polishing appointment at the same clinic. That visit had been fully covered by her company insurance.

On checking the records, she noticed she had been billed over S$500 — again, for what she believed was a routine procedure. When she raised the issue with clinic staff, she was allegedly told, “don’t complain me, complain the doctor”.

For most Singaporeans, that’s a red flag moment.

Reports Filed, Clinic Responds

Shannon has since lodged reports with the Singapore Dental Council and the Singapore Police Force. She also raised the matter directly with Q&M.

In an email response, Q&M apologised for her experience and said the matter was under investigation. A spokesperson later confirmed to Mothership that an internal review is ongoing, though no further details were shared due to patient confidentiality.

The police have also confirmed that a report has been received.

What This Means for Patients in Singapore

Dental insurance in Singapore almost always comes with annual caps, item limits, and exclusions. Clinics should be aware of this — and patients should never be charged for procedures they did not consent to or undergo.

If something feels off, don’t rush to pay. Ask for an itemised bill, clarify each line, and speak up immediately. No need to overthink — your money, your rights.

Frequently Asked Questions

Can a dental clinic charge insurance without my approval in Singapore?

No. Any treatment, especially major procedures, should be explained and agreed to beforehand. Charging for unrendered services may raise ethical and regulatory concerns.

What should I do if I suspect overcharging by a dentist?

Request a detailed invoice, document everything, and raise the issue with the clinic. If unresolved, you can report the matter to the Singapore Dental Council.

Are company dental insurance plans usually unlimited?

Almost never. Most plans have annual caps, per-visit limits, and exclusions. Always assume there is a cap unless clearly stated otherwise.