KEY HIGHLIGHTS

- CDC Vouchers, SG60 Vouchers and LifeSG Credits continue rolling out across 2026 to help Singaporeans cope with daily expenses.

- Used properly, these schemes can significantly ease groceries, meals and child-related costs — especially for freelancers and SEPs.

- Smart planning can free up real cash flow, even with rising prices and CPF changes.

For freelancers and self-employed persons (SEPs), the impact is even sharper. Income can swing month to month, CPF contributions are being phased in for platform workers, and there’s no employer buffer. Used strategically, vouchers don’t just save money — they stabilise cash flow when it matters most.

What voucher support is available in 2026

Most Singaporean households will receive support from three key schemes in 2026, each covering different everyday needs.

| Scheme | What it covers | Best used for | Validity |

|---|---|---|---|

| CDC Vouchers | Hawkers, heartland shops, major supermarkets | Daily meals, groceries, essentials | Typically within 2026 |

| SG60 Vouchers | Broad-based spending categories | Festive and planned expenses | Through end-2026 |

| LifeSG Credits | Child-related and education expenses | School needs, enrichment | Depends on credit type |

Together, these schemes target the areas hit hardest by inflation — food, groceries and family expenses — which is where most households feel the squeeze first.

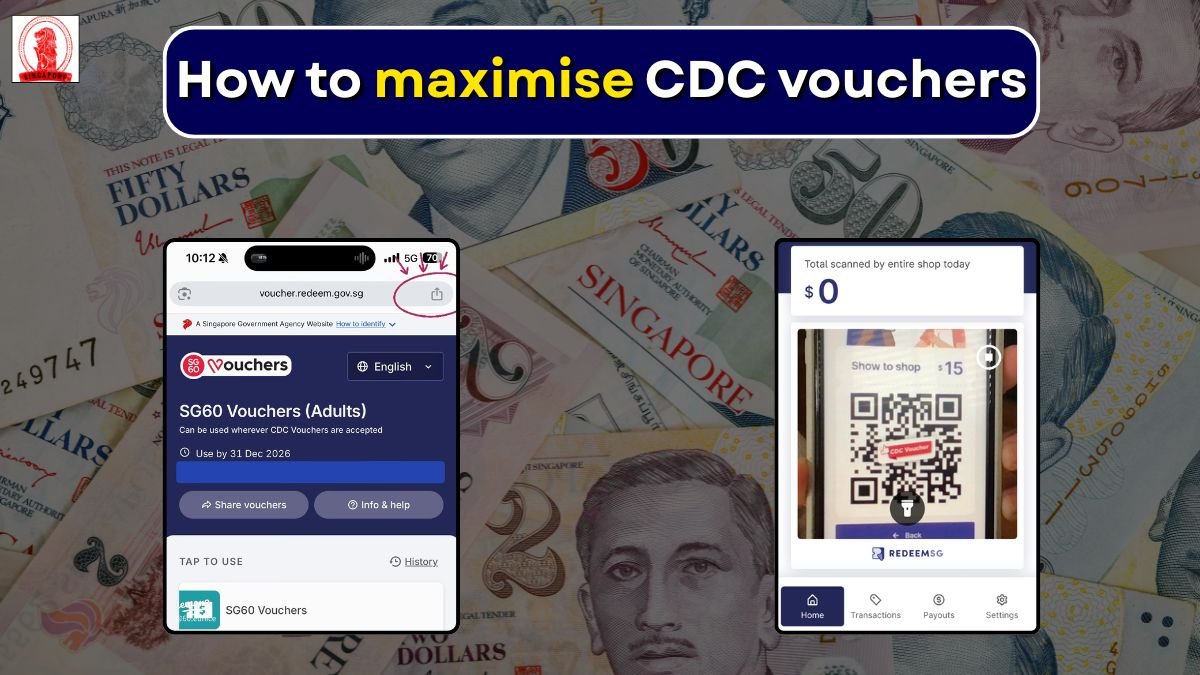

How to claim CDC Vouchers and SG60 benefits

Claiming your CDC Vouchers remains fully digital and fuss-free. Head to RedeemSG, log in with Singpass, and your household’s allocation will be available instantly. After claiming, you’ll receive a unique voucher link via SMS.

There’s no app to install. Just open the link and scan the QR code at participating merchants when you pay.

If you’re helping seniors or family members who aren’t comfortable with smartphones, Community Centres (CCs) still provide in-person assistance, including printing vouchers if needed.

SG60 Vouchers will be rolled out progressively in 2026, starting with seniors. The claiming process follows the same RedeemSG flow, with CCs again supporting those who need help.

Practical tip: Before each new payout, double-check that your Singpass is active and your mobile number is updated. Most delays happen because of outdated contact details.

Stretching your vouchers instead of rushing to spend them

The biggest mistake people make? Spending vouchers the moment they arrive without a plan. A bit of timing goes a long way.

Plan merchants in advance

Use the RedeemSG merchant list to map out hawkers, minimarts and supermarkets near your home or workplace. This way, voucher use fits naturally into your routine — no extra travelling, no impulse spending.

Time supermarket spending properly

Supermarket vouchers work best when stacked with promotions. Use them during sales periods for rice, cooking oil, toiletries and cleaning supplies — items with longer shelf life.

Heartland merchant vouchers are better saved for fresh food and daily meals, where price inflation hurts the most and stockpiling isn’t practical.

Use SG60 Vouchers for big-ticket periods

Because SG60 Vouchers last through end-2026, they’re ideal for predictable spending spikes such as Chinese New Year, Hari Raya, Deepavali and school holidays. Spreading them across the year smooths out cash outflows instead of hitting your bank account all at once.

Freelancer and SEP strategies that actually work

For freelancers and SEPs, vouchers function less like discounts and more like a buffer.

Managing irregular income

Create a simple voucher calendar around high- and low-income months. During slower periods, use vouchers for groceries and meals so your cash income can go toward transport, equipment upkeep, software subscriptions or insurance.

That breathing room matters more than people realise.

Reducing workday costs

If you work on the move — delivery riders, private-hire drivers, technicians — CDC-accepting hawkers near common routes can quietly save S$5–S$10 a day. Over a month, that’s real money back in your pocket.

When work picks up, use supermarket vouchers early to stock up at home so you can focus on earning instead of daily errands.

CPF contributions and take-home pay

Mandatory CPF contributions for platform workers born on or after 1 January 1995 continue phasing in through 2026. While this strengthens long-term security, short-term take-home pay does dip.

Vouchers help offset daily expenses during this adjustment period, especially when combined with Platform Workers CPF Transition Support (PCTS) and Workfare Income Supplement (WIS) if you’re eligible.

Making the most of LifeSG Credits for families

Child LifeSG Credits are most effective when used for predictable expenses. Think textbooks, assessment books, uniforms, stationery and digital learning tools.

Some families also stretch value by allocating credits toward enrichment classes or learning resources that support long-term development, not just immediate needs.

The key is planning ahead instead of reacting when bills arrive.

Combine vouchers with other support — not separately

Vouchers work best as part of a bigger picture. Lower-income SEPs can coordinate usage alongside WIS payouts, GST Voucher components and training subsidies.

When vouchers cover daily essentials, cash savings can be redirected toward upskilling, insurance or emergency funds — areas that build longer-term stability rather than short-term relief.

Practical reminders most people overlook

Claim vouchers early, but don’t rush spending

Track different expiry dates carefully

Take screenshots of QR codes as backup

Watch seasonal price patterns before redeeming

Bookmark RedeemSG for updated merchant lists

Small habits make a big difference over a year.

Building financial resilience beyond 2026

Used well, vouchers don’t just reduce expenses — they create space. Savings from daily spending can go into emergency funds, insurance premiums, voluntary CPF contributions or paying down high-interest debt.

For freelancers and self-employed Singaporeans, that breathing room is what turns short-term support into long-term resilience.

As cost pressures continue, CDC Vouchers, SG60 Vouchers and LifeSG Credits remain some of the most practical tools available. With planning and discipline, they can carry you through 2026 — and leave you in a stronger position after.

Frequently Asked Questions

Do freelancers and self-employed persons qualify for CDC and SG60 Vouchers?

Yes. Eligibility is household-based, not employment-based. Freelancers and SEPs receive vouchers as long as their household meets the criteria.

Can unused SG60 Vouchers be carried into 2027?

No. SG60 Vouchers are valid through end-2026 only. Any unused balance will expire after that.

Is it better to use vouchers early or save them?

Claim them early, but spend them strategically. Using vouchers during high-expense periods usually gives better value than spending everything immediately.