KEY HIGHLIGHTS

- Your CPF OA first S$20,000 earns up to 3.5% or 4.5% interest in Singapore

- Extra interest is paid into SA or RA, not left idle in OA

- Simple rule, but huge long-term impact on retirement savings

Most Singaporeans know CPF OA earns 2.5% p.a.

But the real story starts with the first S$20,000.

That portion quietly earns more than you think, thanks to CPF’s extra interest scheme.

And no — this is not a promotion.

It’s a standing CPF rule that many people still miss.

For Q1 2026, here’s how it works.

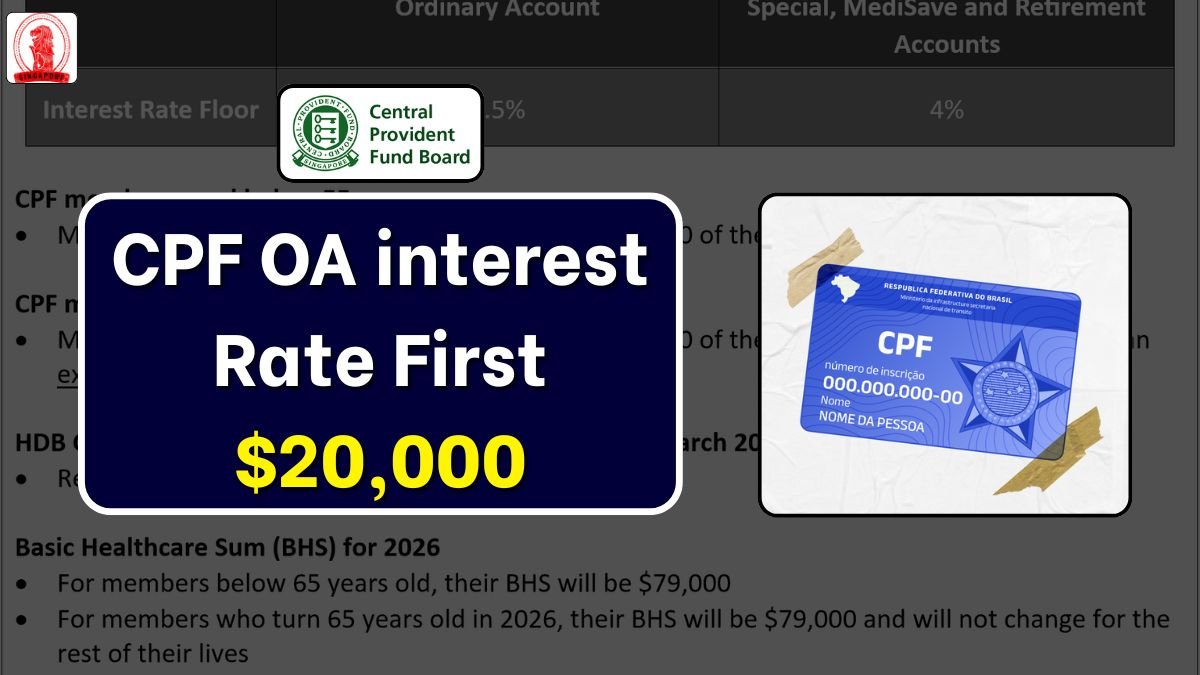

CPF OA First S$20,000 Interest Rate 2026

| Age Group | OA Base Rate | Extra Interest | Effective Return on First S$20k | Where Extra Interest Goes |

|---|---|---|---|---|

| Below 55 | 2.5% | +1% | 3.5% p.a. | Special Account (SA) |

| 55 & above | 2.5% | +2% | 4.5% p.a. | Retirement Account (RA) |

The Standard CPF OA Rate (Q1 2026)

CPF Ordinary Account pays a base interest of 2.5% p.a.

This rate is reviewed quarterly, but 2.5% has been stable for years.

No lock-ins.

No conditions.

Your OA balance just earns it automatically.

Extra Interest: Where the Boost Comes From

This is the part most people overlook.

CPF gives extra interest on your combined CPF balances — OA, SA and MA.

But there’s a cap on how much can come from OA.

If You’re Below 55

- +1% p.a. on the first S$60,000 of combined CPF balances

- Maximum S$20,000 can be from OA

That means your first S$20,000 in OA effectively earns 3.5% p.a.

Important detail:

👉 The extra 1% does not stay in OA

👉 It is credited into your Special Account (SA)

Honestly speaking, this is CPF nudging you to grow retirement savings faster.

If You’re 55 and Above

Even better.

- +2% p.a. on the first S$30,000 of combined balances

- +1% p.a. on the next S$30,000

- Still capped at S$20,000 from OA

So for that first S$20k in OA:

- 2.5% + 2% = 4.5% p.a.

The extra interest goes into your Retirement Account (RA).

Why This Matters More Than You Think

That extra interest:

- Is risk-free

- Is paid monthly

- Ends up in SA or RA, which earn higher long-term rates

Over 20–30 years, this compounds quietly but powerfully.

For most Singaporeans, this is one of the safest “returns” you’ll ever get — no need to buy anything, no need to apply.

Should You Keep S$20,000 in OA?

For most Singaporeans, yes.

Reasons:

- You keep liquidity for housing

- You still get enhanced interest

- Extra interest strengthens retirement accounts automatically

No need to overthink or micromanage.

Beyond S$20k, the maths becomes more personal — housing plans, investments, age, and risk comfort all matter.

Frequently Asked Questions

Does the extra interest stay in my CPF OA?

No.

The extra interest is paid into SA (below 55) or RA (55 and above), not into OA.

Do I need to apply for this extra interest?

No action needed.

CPF credits it automatically every month as long as you qualify.

Is the 2.5% OA rate guaranteed?

CPF reviews it quarterly, but 2.5% has been the long-term floor set by policy.